Bank11.io

Introduction

Today, the global financial system is experiencing major challenges, such as sanctions and trade wars, banking regulations, rising borrowing costs and key interest rates, and an inflationary, spike. Classic fiat instruments can't overcome these challenges. Blockchain, cryptocurrencies and Web 3.0 solutions in the field of finance are essential for this crisis. Unfortunately major blockchain companies work only for a narrow audience of crypto-enthusiasts. Under these conditions, users need new innovative financial services that will-combine Web 3.0 and large scalability.

Mission

The economic crisis is accelerating a revolution in finance that will power the development of non-fiat banking. X11's mission is to give people back the ability to manage their own money without restrictions. The X11 team decided to create a non-fiat service that combines innovative fintech solutions with the reliability of a classic bank. X11 works as a hybrid service implementing CeFi and DeFi solutions. Cef i will provide the level of compliance the service needs, while DeFi maintains the. transparency of blockchain solutions and the decentralized nature of the service, as well as the scalability of cryptocurrency payments.

Financial institutions must stop dividing people into insiders and outsiders X11 will remove borders and nationalities from finance. We want to give our users access to banking services anywhere in the world without restrictions, regardless of sanctions and trade wars. X11 will be the service for a new global financial system based not on fiat currencies but on cryptocurrencies

Target audience

X11's audience encompasses both individuals and legal entities including Individuals

1. Freelancers who work for clients in other countries

2. For cross-border SME transactions

3. For p2p payments and keeping private funds

• Online business

4. Gambling, betting

5. Gaming

6. Meta-universes

7. Blockchain companies

Problems

Problem 1. Crypto banking is still at the beginning stage of development Many blockchain companies have been created in recent years, including cryptocurrency exchanges and DeFi protocols, which provide different financial crypto services. However, there is not a single full-fledged cryptocurrency bank among them. The vast majority of so-called crypto-banks are either crypto-exchanges that issue debit cards, or neobanks that conduct cryptocurrency transactions on a very limited scale.

Problem 2: Traditional banks and neobanks are over-regulated Fintechs and neobanks, relying on fiat financial infrastructure and being constrained by regulators, do not meet user expectations. Comparing modern banking with the banks of the past, privacy and the quality of service have significantly decreased.

Problem 3: Centralized crypto-exchanges and blockchain services are limited by regulators

Sanctions, trade wars and the international economic crisis are affecting clients of crypto-exchanges and blockchain services. No client can feel safe and at any moment their money can be blocked or confiscated, even if it is of legal origin.

Problem 4. Scalability of DeFi and cryptocurrencies

Defi, the backbone of innovation in finance and the blockchain industry, has not been implemented in banking. The number of cryptocurrency users is still only about 300 million, due to difficulties in implementing user-friendly interfaces.

Problem 5: The fiat system crisis

The modern fiat system has a number of serious disadvantages, notably high inflation and the lack of freedom for people to manage their money.

Problem 6. Zero interest rates on bank accounts

During the COVID pandemic, bank account interest rates in the EU, the US and the British Commonwealth fell to near zero.

Problem 7: Risks and Difficuties

Cryptocurrency has given users the opportunity to make fast, inexpensive and private transactions outside the fiat system. At the same time, it generates many problems, such as fraud and address errors in transactions, not to mention that the legal field for such transactions is still a gray area in many countries. Business

payments in cryptocurrency are high-risk and do not protect either client or counterparty.

The high volatility of cryptocurrencies tiscourages transfers. This problem was "solved" by stablecoins, but even those transactions can be expensive and it is unclear to whom and where funds are going and who is behind them. X11 has solved this problem.

Conversely, classic banks require very serious documentation and confirmation of the origin of funds, both for individuals and businesses. Also, citizens of some countries have great difficulty registering a personal business account, with a process that takes from 3 weeks to 6 months

Tokenomics and the X11 economic model

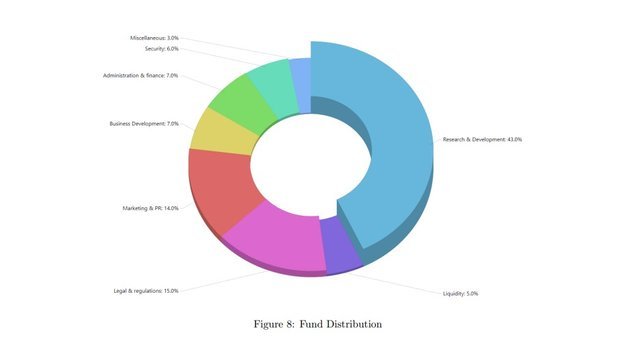

X11's economic model is based on maximum interaction between the service and its customers through the provision of convenient and exclusive services without intermediaries. X11 has several main sources of profit in its operating activities:

. Commission for geocash service - 1%

• Commission for transaction arbitrage - up to 10%

• Fee for transfers-from $1 to 1%

• Loans secured by cryptocurrencies- 13.5% per annum

X11 will ensure high user activity. The base scenario of service development assumes that users will make millions of transactions in the first months of X11 operation. Taking into account the minimum fee of $1, this will provide the project with a high level of profitability.

Another important component of the X11 economic model is that the customer earns with the service on the growth of X11 token capitalization and is a co-investor in X11.

Transparency

All information about the service's work is transparent and accessible to investors, and every year the service's accountant will make detailed financial reports and display them in personal accounts. This financial model will bypass the bureaucracy with the attraction of venture capital investment and give the opportunity to earn users

Internal token xUSD

The xUSD coin will be used for settlements in stablecoin inside the service. Free exchange of xUSD for other staking currencies will be implemented.

IDO

Total X11 issue 11,000,000,000

Reserve for IDO: 1,000,000,000

There will be a project IDO, where tokens will be sold for the equivalent of US$10,000,000, to fill the liquidity of the service itself

External X11 token and staking program

X11 is X11's native external token. The X11 token will be traded on decentralized exchanges.

Users can buy x11 tokens inside the system and stake it for interest, the more tokens, the higher the interest. This encourages users to invest in buying the token. The proceeds will go to replenish the liquidity of X11 itself At the end of the year, 20% to 50% of the service's profits will be used to buy back tokens, after which they will be burned. All this stimulates the growth of X11 capitalization

Already done

06.06.2021 — Beginning building a bank11 model

09.01.2022 — Launch of beta version for individuals

11.01.2022 — Beta launch versions for freelancers

02.01.2023 — Launch of alpha version for freelancers

07.01.2023 — Test of the Bank11 application on trc

20 08.01.2023 — Signed contracts with the European payment system so that our clients have the opportunity to withdraw funds to the card

What was missing all this time

Instant Registration

Fast and simple KYC/KYB compliance (passport/license)

Instant 30-second money transfers

Low fees on transactions

Acquire crypto

Integration of browser wallets with your site/store. Merchants receive payments in stablecoins without worrying about additional fees or volatility

No limits on transaction volume

Free banking: you pay only for the services you use

Earn on p2p lending

Escrow deals with an arbitrator: deals signed by a smart contract and legal agreement

No country restrictions: we do not work with fiat licenses

Geocash service for fiat withdrawal (p2p exchange between bank clients)

Legal

Bank 11 complies with English law. All legal contracts will be directly linked to smart contracts. The user can sue a counterparty who does not fulfill the contract in their own country or in the arbitration court.

Bank 11 complies with English law. All legal contracts will be directly linked to smart contracts. The user can sue a counterparty who does not fulfill the contract in their own country or in the arbitration court.

Bank 11 does not have access to the client's funds, only information about the counterparty, transactions and the amount of funds. Bank 11 takes payments only in the form of fees, when the client interacts with bank tools. Commissions are automated by smart contracts.

Bank 11 does not have access to the client's funds, only information about the counterparty, transactions and the amount of funds. Bank 11 takes payments only in the form of fees, when the client interacts with bank tools. Commissions are automated by smart contracts.

COMPARISON OF BANK 11 AND TRADITIONAL BANKS

What's the benefit?

Instant money transfers anywhere

Low fees on international money transfers through Bank 11 gateway

Fast registration

Verification within 24 hours

Opportunity to earn on p2p lending

Withdraw fiat via geocash

Ability to pay bills and make purchases in cryptocurrency

No limits on transaction volume

Escrow deals for payments for goods and services

Bank 11 has no control over client funds

Classic Bank

Money transfers up to 14 days

High fees for cross-border transfers up to 15% of the amount depends on the country

Transfers to some countries are prohibited, no withdrawals to blockchain

Account opening takes from 2 days to 2 weeks

Citizens of some countries are forbidden to open an account

Only direct bank loans at % interest

Receipt of funds via wire transfer or cash at bank/ATM only

Limits on servicing accounts

Bank is not responsible for client deals

Can block client funds at any time

#Bank11 #Xeleven #CAR #BTC #Sango #Metaverse #NFT #Binance #ETH #Ethereum

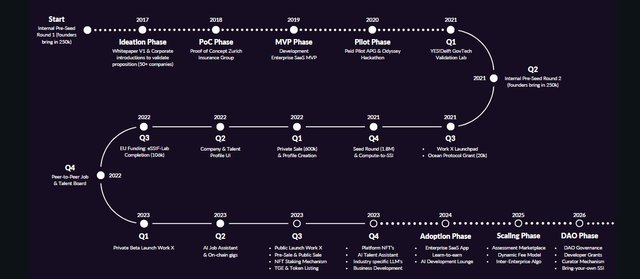

Roadmap

QI-II 2022.

Documentation development

Individual design development (prototyping)

Emergence of the Development Team

Company registration in Panama

Hypothesis testing

Project tokenomics

QIII-IV 2022.

Service landing page

Registration and login

KYC/KYB

Invoice generation and payment

Stablecoins exchange

1-3K registrations planned

QI 2023

ESCROW Module

IOS/Android application launch

Buy Ethereum with card

Geo-Cash + P2P withdraw to card

The possibility of buying a X11b token and staking it

Internal chat

Taking over the African market (10-30k users)

Team

The X11 team consists of specialists with many years of experience in the blockchain industry. The X11 product is developed by a team of four experienced engineers with the necessary competencies in blockchain development (Solidity, Rust) and the creation of frontend solutions for Web 3.0 applications in JavaScript, Typescript, Node.js and React.js.

X11's legal department is led by a lawyer with extensive operating experience with CeFi companies as well as advising DeFi projects. The strategic focus on the use of decentralized solutions, combined with legal literacy, allows the company to find effective legal solutions that are convenient for our clients.

X11's marketing and product department is led by experts with dozens of successful marketing campaigns since the first major ICO in 2017 and experience with cryptocurrencies, cryptocurrency exchanges, and DeFi protocols in 2020-2021.

INFORMATION

https://acrobat.adobe.com/id/urn:aaid:sc:AP:0353d534-1607-4fc1-b09f-21c72d6e8bb2

AUTHOR

Bitcointalk Username: Fatin Elyana Syakira

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3342657

Wallet Address: 0xe45b66263a076dc537d91cd4971ff70d8c30ffc7